Introduction

Investing is an essential part of securing our financial future. While traditional investment options like stocks, bonds, and real estate have been popular choices, art and collectibles are gaining significant attention as alternative investment assets. This article aims to explore the art and collectibles market as an investment opportunity. We will delve into the potential returns, risks, and factors to consider when investing in this unique asset class.

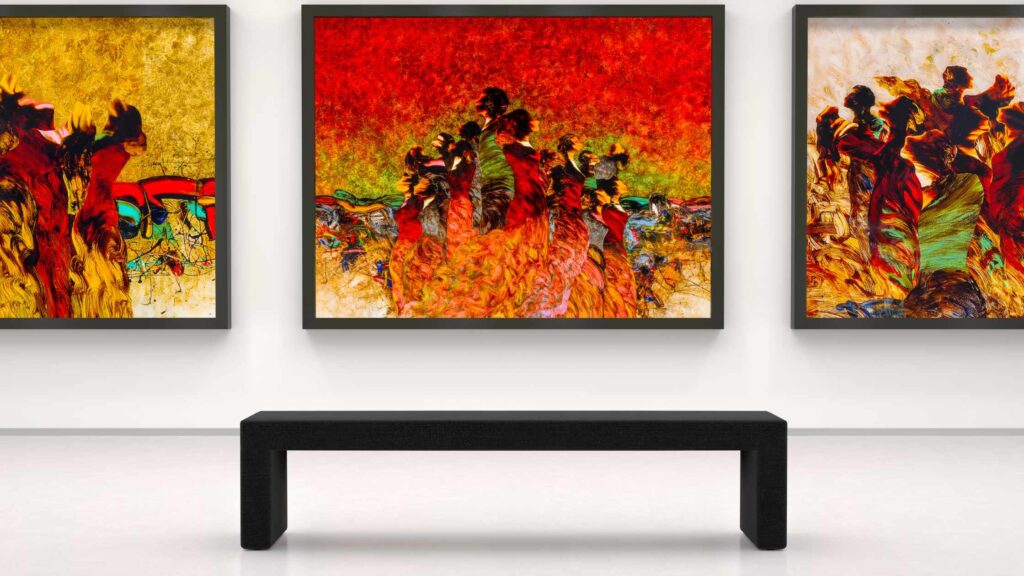

Art and Collectibles as Investments

Art and collectibles have experienced a surge in popularity among investors. The allure lies in their ability to provide both aesthetic pleasure and potential financial gain. Unlike stocks or bonds, which are intangible, art and collectibles offer a tangible connection to history, culture, and artistic expression.

Historical Performance

Historical data showcases the potential financial benefits of investing in art and collectibles. For instance, studies have shown that high-quality artwork has consistently outperformed the stock market over the long term. The Mei Moses World All Art Index, which tracks art performance, has demonstrated an average annual return of around 5.5% since 1950.

Diversification and Inflation Hedge

Investing in art and collectibles can offer diversification benefits. The art market is generally considered to have a low correlation with traditional financial markets. Therefore, adding art and collectibles to an investment portfolio can potentially reduce overall risk by providing a hedge against market volatility.

Additionally, art and collectibles have often acted as a hedge against inflation. Due to their scarcity and intrinsic value, these assets have historically maintained their worth during times of economic uncertainty.

Factors to Consider

Before investing in art and collectibles, it is crucial to consider several factors:

Expert Advice and Research

Given the complexity of the art market, seeking expert advice is essential. Engaging art consultants, curators, or appraisers can provide valuable insights into the authenticity, provenance, and potential investment value of artworks and collectibles.

Historical Significance and Condition

Artworks with historical significance and those in excellent condition tend to hold greater value. Pieces created by renowned artists or from significant art movements often fetch higher prices and may potentially appreciate more in the future.

Rarity and Limited Supply

Rarity plays a crucial role in determining the value of art and collectibles. Scarce items or limited-edition works are often highly sought after and can command substantial prices. Be sure to consider the supply and demand dynamics of the specific artist or collectible you are considering.

Preservation and Storage

Proper preservation and storage are vital to maintain the value and condition of art and collectibles. Factors such as temperature, humidity, and protection from light and environmental damage must be carefully managed to ensure the longevity and marketability of these assets.

Risks

While art and collectibles have the potential for significant financial gains, it’s crucial to understand the associated risks:

Market Volatility and Illiquidity

The art market can be highly unpredictable and subject to fluctuations. The value of artworks and collectibles can vary drastically based on factors such as trends, changing tastes, and market conditions. Additionally, selling art or collectibles may not be as straightforward or quick as selling traditional investments due to the illiquid nature of the market.

Authenticity and Provenance

Art forgery is a significant risk in the art market. Investing in due diligence to authenticate artworks and verify their provenance is crucial. Provenance refers to the history of ownership, ensuring that the artwork was legitimately acquired. Failure to authenticate or verify provenance can result in significant financial loss.

Summary

Art and collectibles offer an intriguing investment opportunity in addition to their cultural and aesthetic value. As with any investment, understanding the market, associated risks, and relevant factors is vital. The art and collectibles market can provide diversification, act as an inflation hedge, and potentially generate significant returns over the long term.

However, it is crucial to conduct thorough research, seek expert advice, and carefully consider the authenticity, historical significance, condition, rarity, and preservation of potential investments. Keep in mind the risks associated with market volatility and the need for proper due diligence in the art market. Assimilating art and collectibles into a well-rounded investment strategy can add a touch of beauty and potential financial growth to your portfolio.