Relocating in Retirement: Weighing the Financial and Emotional Factors

Introduction Retirement is a major life milestone that often comes with various decisions to be made. One such decision is whether or not to relocate. Many retirees contemplate moving to a different location for a variety of reasons. However, before making this significant change, it is essential to weigh the financial and emotional factors involved. […]

Legacy Planning: Passing on Your Wealth and Values

Introduction to Legacy Planning Legacy planning involves more than just transferring financial assets to the next generation. It is about ensuring that your wealth, values, and life’s work continue to have a positive impact long after you’re gone. By putting a comprehensive plan in place, you can provide for your loved ones, support charitable causes, […]

The Role of Pensions in Retirement Planning: What to Expect

Introduction Retirement planning is a crucial aspect of financial management, ensuring a comfortable and secure future. One of the key components of retirement planning is a pension. In this article, we will explore the role of pensions in retirement planning and what you can expect from them. Understanding Pensions Pensions are retirement savings plans that […]

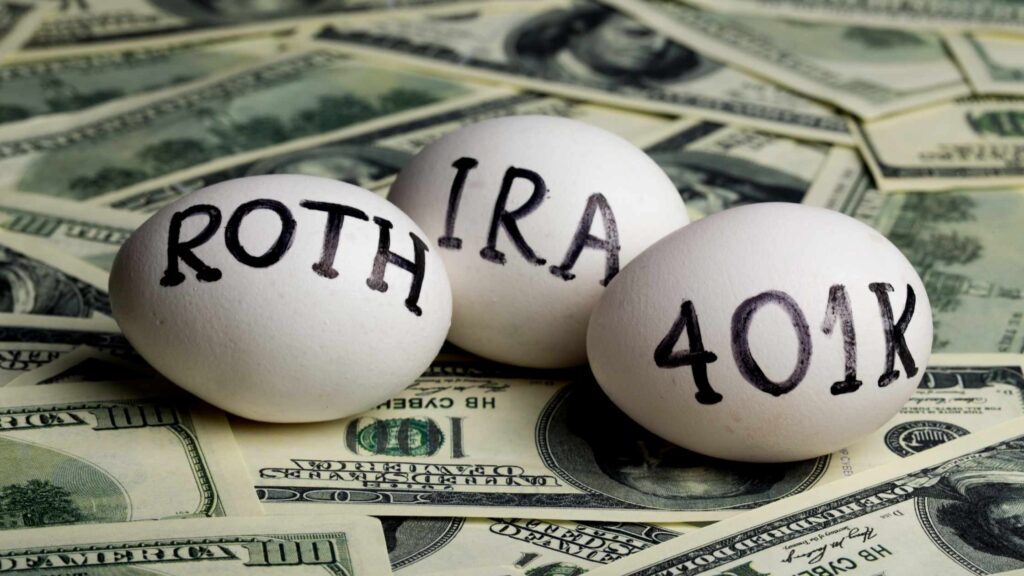

Navigating Different Retirement Accounts: 401(k), IRA, Roth IRA, and More

Introduction Retirement planning is a crucial aspect of personal finance. As you start thinking about your retirement goals, it’s important to understand the different retirement account options available to you. This article will provide a comprehensive guide to navigating various retirement accounts, including 401(k), IRA, Roth IRA, and more. Understanding 401(k) Accounts What is a […]

Assessing Your Risk Tolerance in Retirement Investing

Introduction Retirement investing is a critical aspect of securing one’s financial future. However, it is essential to understand and assess your risk tolerance before making any investment decisions. Your risk tolerance defines your ability to handle the ups and downs of the financial markets and helps determine the appropriate investment strategy suitable for your retirement […]

Planning for Healthcare Costs in Retirement: Medicare and Beyond

Introduction Retirement is a time to relax and enjoy the fruits of your labor. However, it’s essential to ensure that you have planned for all the potential costs that may arise during this stage of life. One significant aspect that often catches retirees off-guard is healthcare expenses. In this article, we will dive into the […]

The Pros and Cons of Retiring Early: Weighing the Financial Impact

Introduction Retiring early is a dream for many individuals who want to escape the daily grind and enjoy their golden years while they are still young and healthy. However, before making a decision, it is crucial to consider the financial impact of retiring early. In this article, we will explore the pros and cons of […]

Downsizing in Retirement: Making the Most of Your Nest Egg

Introduction Retirement is a phase of life that many look forward to, a time when the daily grind is replaced with leisurely pursuits. However, for a comfortable retirement, financial planning is crucial. One strategy that retirees often consider is downsizing. In this article, we will delve into the concept of downsizing in retirement and explore […]

Strategies for Catching Up on Retirement Savings in Your 40s and 50s

Introduction Retirement planning is a crucial aspect of financial stability and security. However, life can get in the way, and many individuals find themselves behind on their retirement savings as they reach their 40s and 50s. The good news is that it’s never too late to start catching up on your retirement savings. In this […]

Understanding Social Security: Maximizing Benefits for a Secure Future

Introduction Social Security is a critical component of retirement planning for individuals in the United States. Understanding how it works and how to maximize its benefits can greatly impact your financial security in retirement. In this article, we will delve into various aspects of Social Security, including eligibility requirements, claiming strategies, and the potential impact […]